Haynes Publishing Group have announced that the company’s directors have put the business up for sale. This comes ahead of the company’s 60th anniversary in 2020 and shortly after the death of founder John Haynes. As Friday’s RNS points out, the company has made a successful transition from the production and sale of the iconic Haynes car repair manuals to online services providing data for industry. Part of this transition has involved various bolt-on purchases as well as bringing the company into the 21st century through the use of technology. The 2016 purchase of OATS Limited helped Haynes add a lubricant database business, while buying E3 Technical in 2017 helped incorporate automotive data solutions.

It seems a little sad that the Haynes family would part ways with the business after the passing of John Haynes. However, we cannot know the circumstances behind this decision and the RNS nevertheless states that the family wishes to see the company be guided through another “60 years of success” by an organisation that can “invest for future expansion”. A previous notice on 18 October outlined how John Haynes’ 56 per cent shareholding was to be divided up between his wife Annette, sons J and Chris, as well as grandchildren. Chris Haynes is the managing director of Bute Motorsport and J Haynes has held the position of Haynes CEO since mid-2016. J Haynes previously worked in investment banking and has an MBA under his belt, so is well-placed to lead the sale of the firm.

Haynes have appointed London-based boutique investment bank Europa Partners to advise on the sale. Europa boasts of having advised on the sale of New Scientist magazine and done fundraising for Sofa Brands International, according to the recent deals section of their website. Haynes is likely to look relatively attractive to any would-be suitor – it has no debt, cash of almost five million GBP, steadily growing revenue and profit over the past four years, and reliable dividends. Although it is quite a specialised outfit straddling both consumer and professional content.

Going back to the sadness I expressed about the company’s sale – I think this is rather sadness that I’ll no longer be able to share in Haynes’ consistent dividends and growth story. I first bought in at 189p per share in November 2012, attracted by the strong dividend yield. I topped up further at 164p per share in April 2017 when the stock exhibited some weakness, and then less than a year later sold part of my holding at 212p per share. At the current price of 425p per share, I’ve booked a 48 per cent profit including gains in the stock and dividends I’ve been paid.

Based on total outstanding shares at a price of 425p, Haynes would be worth 69.4 million GBP, although the shares went as high as 455p early on Friday morning. I won’t get into calculations or speculation on a potential valuation, although I feel that the company’s heritage and solid transition to digital should stand it in good stead.

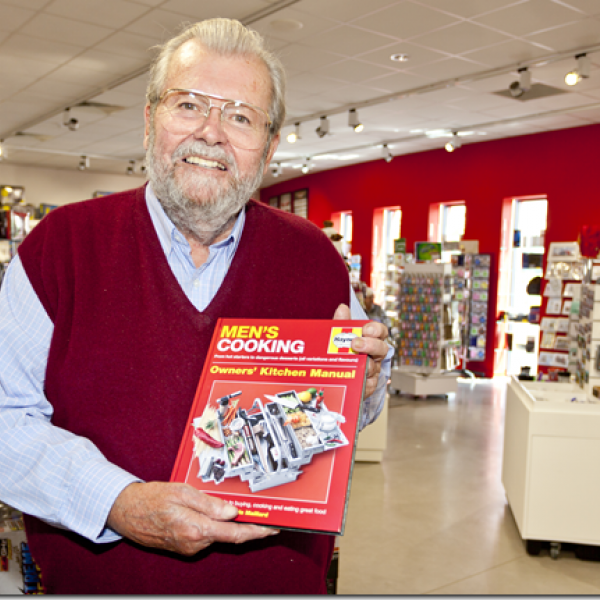

Main photo: Founder John Haynes with a copy of Men’s Cooking manual.

Disclaimer

This website is provided “as is” without any representations or warranties, express or implied. River Otter Investments makes no representations or warranties in relation to the information on this website. The website is not intended to address your particular requirements. In particular, the information on this website does not constitute any form of advice or recommendation and is not intended to be relied upon by users for investment decision-making purposes.

Great post and thanks for the feedback on the Cube Investments website!

LikeLiked by 1 person